Mortgage Forbearance: A Lifeline for Riverside County Homeowners Facing Financial Challenges

Life can be unpredictable. Whether it's a job loss, unexpected expenses, or a natural disaster, financial hardships can happen to anyone. If you're a homeowner in Riverside County struggling to keep up with your mortgage, there's an option that could provide much-needed relief: mortgage forbearance.

What Is Mortgage Forbearance?

Simply put, mortgage forbearance allows homeowners to temporarily pause or reduce their mortgage payments while they navigate financial difficulties. Contrary to popular belief, forbearance wasn’t just a COVID-era solution—it’s still available today for homeowners facing short-term hardships.

Why Does This Matter Now?

While forbearance rates remain low overall, recent natural disasters—including major storms—have led to a small but noticeable increase in homeowners seeking assistance. In fact, nearly half of homeowners currently in forbearance cite natural disasters as the cause.

The Current State of Mortgage Forbearance

Forbearance continues to serve as a valuable safety net for homeowners facing temporary financial challenges. While the overall rate of forbearance has seen a slight increase recently, it’s important to understand what’s driving this change and how it fits into the broader picture.

According to Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA):

“The overall mortgage forbearance rate increased three basis points in November and has now risen for six consecutive months.”

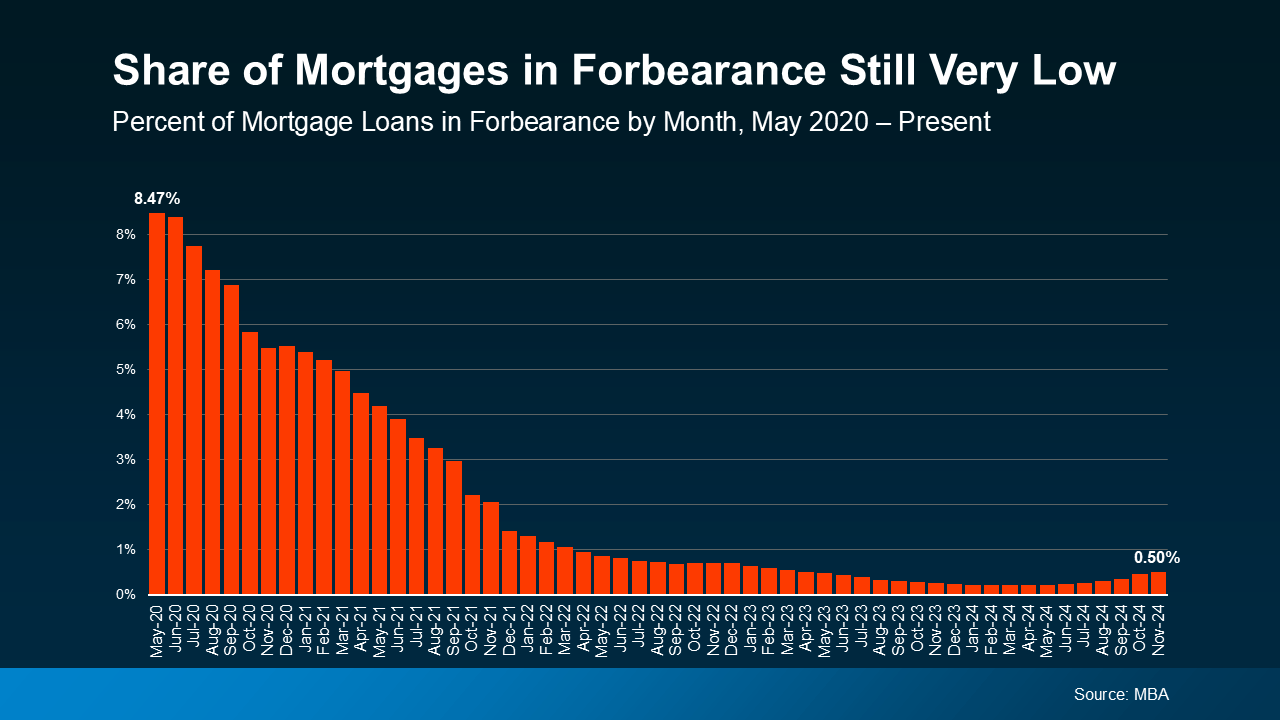

This may seem concerning at first glance, but let’s break it down. The graph below, going all the way back to 2020, puts things into perspective:

While the share of mortgages in forbearance has significantly declined since its peak in mid-2020, there has been a slight but notable increase in recent months. This uptick is largely tied to the effects of two recent hurricanes — Helene and Milton.

While the share of mortgages in forbearance has significantly declined since its peak in mid-2020, there has been a slight but notable increase in recent months. This uptick is largely tied to the effects of two recent hurricanes — Helene and Milton.

Natural disasters like these often create temporary financial hardships for homeowners, making forbearance a crucial safety net during recovery. In fact, 46% of borrowers in forbearance today cite natural disasters as the reason for their financial struggles.

Even with the most recent uptick, the share of mortgages in forbearance is nowhere near pandemic levels, and, thankfully, reflects a very small portion of homeowners overall.

How Forbearance Can Help

If you're struggling to make your mortgage payments, forbearance can:

✅ Help you avoid missed payments and foreclosure

✅ Give you time to regain financial stability

✅ Provide peace of mind while you explore long-term solutions

What Should You Do Next?

If you’re facing financial difficulties, don’t wait—reach out to your mortgage lender as soon as possible. Forbearance isn’t automatic; you’ll need to apply and discuss your options. Every situation is different, and having the right guidance can make all the difference.

Let’s Talk!

As a real estate expert in Riverside County, I’m here to help you navigate your options and protect your home. If you have questions about forbearance, home values, or your next steps, let’s connect today.